Estate planning often feels like a daunting task, filled with complicated paperwork and tough decisions. But did you know that it can also have financial benefits? Many people overlook the potential tax advantages that come along with creating an estate plan. If you’ve ever wondered, “Is estate planning tax deductible?” you’re not alone. Understanding how taxes play into your estate strategy can help you save money while ensuring your wishes are honored after you’re gone. Let’s dive deeper into what this means for you and explore the ins and outs of making smart financial choices in your estate planning journey.

Table of Contents

Understanding Estate Planning

Estate planning is not just about drafting a will; it’s a comprehensive strategy for managing your assets. It ensures that your wishes are honored, your loved ones are cared for, and potential disputes are minimized.

At its core, estate planning involves identifying what you own and how you want those assets distributed after your passing. This can include real estate, investments, personal belongings, and even digital assets like social media accounts.

Many people associate estate planning with older age or wealth. However, it’s important for everyone to consider these arrangements regardless of their financial status. Unexpected events can happen at any time.

Moreover, effective estate planning takes into account various legal documents such as trusts, powers of attorney, and health care proxies. Each serves a specific purpose in safeguarding your legacy while streamlining the process for those left behind.

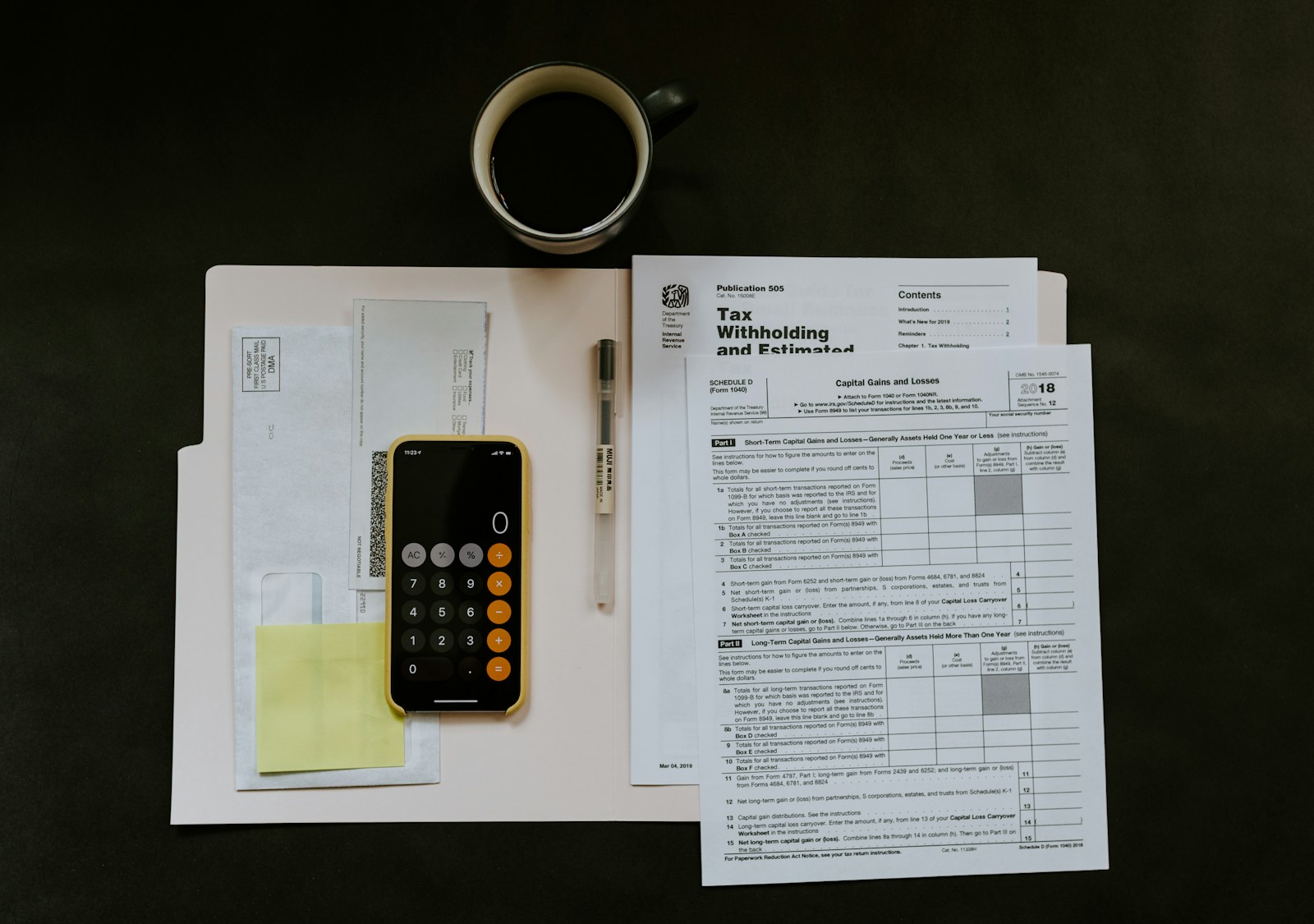

Tax Deductible Expenses in Estate Planning

When considering estate planning, understanding what expenses may be tax deductible is crucial. Certain costs associated with creating a will or trust can often lighten your financial burden.

Legal fees are among the most common deductible expenses. If you hire an attorney to draft legal documents related to your estate, those fees may qualify for deduction. This includes setting up trusts and other necessary preparations.

Additionally, appraisal costs for real estate or valuable items in your estate can also be deducted. Accurately assessing the value of assets ensures you’re not overpaying taxes on them later.

It’s important to keep meticulous records of all expenditures connected to your estate planning process. Documenting these details helps substantiate claims when filing taxes, possibly resulting in significant savings down the line.

Is tax preparation considered financial services

Common Tax Deductible Expenses in Estate Planning

When navigating the world of estate planning, certain expenses can qualify as tax-deductible. Understanding these costs is crucial for efficient financial management.

Legal fees associated with drafting wills and trusts often fall into this category. If you engage an attorney to help create your estate plan, those fees may be deductible on your taxes.

Additionally, if you hire a financial planner or accountant for guidance in establishing your estate plan, their services might also be eligible for deductions.

Costs related to appraising property can be deductible too. This includes any assessments needed to determine the value of real estate or other assets included in your estate.

Remember that not all expenses are automatically deductible. Keeping detailed records will ensure you have the necessary documentation when filing taxes and claiming deductions related to your estate planning efforts.

Shop and get cashback: US & Android Only

Limitations on Tax Deductions for Estate Planning

Tax deductions for estate planning can be beneficial, but they come with limitations. Not all expenses are eligible for deductions, which can lead to confusion.

For instance, personal legal fees related to drafting a will or trust may not qualify. These costs might fall under general living expenses rather than business-related deductions.

Additionally, the IRS has specific guidelines that dictate what constitutes deductible estate planning costs. Without careful documentation and adherence to these rules, taxpayers risk losing out on potential savings.

Furthermore, certain thresholds apply when it comes to deducting estate taxes themselves. If your estate exceeds a particular value, you might face different tax implications that could limit your overall benefits.

Understanding these restrictions is crucial for effective financial planning. Being aware of what qualifies can help avoid unexpected surprises during tax season.

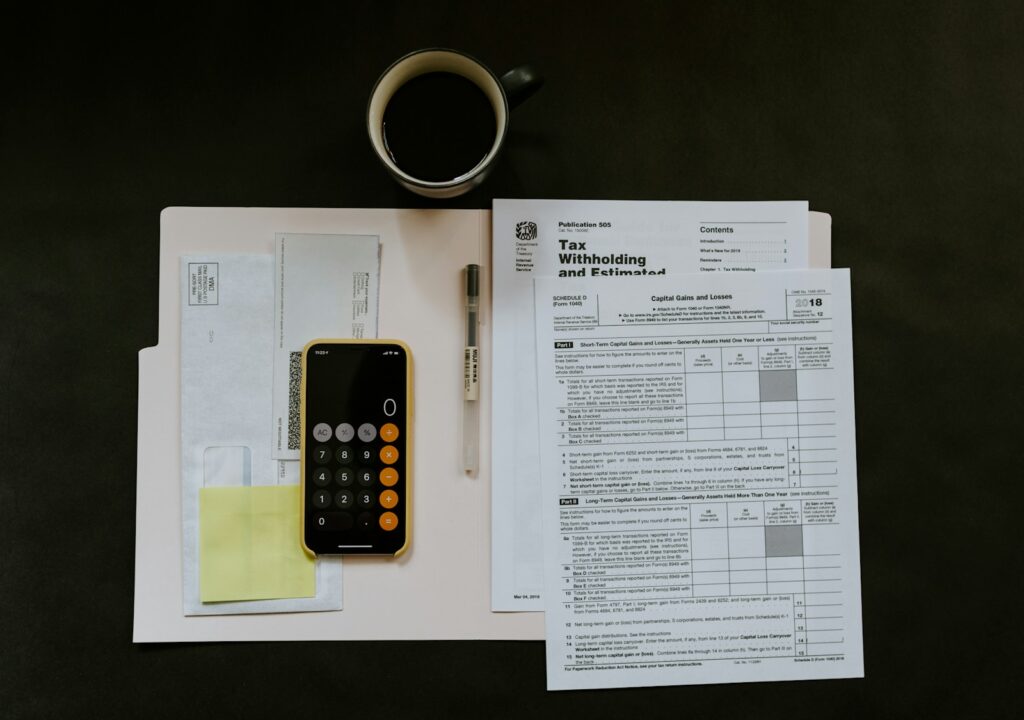

How to Maximize Tax Deductions in Estate Planning

To maximize tax deductions in estate planning, start by identifying all potential expenses. Legal fees for drafting wills and trusts can often be deductible. Always keep receipts and documentation.

Consider establishing a charitable trust. Donations made to qualified charities may provide significant tax benefits while fulfilling your philanthropic goals.

Review any ongoing administrative costs associated with managing an estate. These can sometimes be claimed as deductions during the year of the decedent’s passing.

Utilize life insurance strategically. Premiums paid on policies that benefit your estate might also offer tax advantages under certain conditions.

Engage regularly with a financial advisor who specializes in estate planning. They can help detect overlooked opportunities for deductions tailored to your unique situation.

The Importance of Seeking Professional Advice

Navigating the complexities of estate planning can be daunting. The laws are intricate, and each situation is unique. This makes professional guidance invaluable.

An experienced attorney or financial advisor understands the nuances that can significantly impact your estate plan. They offer insights into tax implications, asset distribution, and legal requirements that you might overlook on your own.

Moreover, professionals stay updated on changing regulations. Tax codes shift frequently, affecting deductions and exemptions related to estate planning.

They also help identify potential pitfalls in your strategy before they become problematic. A misstep could lead to costly mistakes or disputes among heirs down the road.

Engaging a qualified expert not only brings peace of mind but also ensures you’re making informed decisions tailored to your specific needs and goals.

Conclusion

Estate planning is a crucial step in securing your financial future and ensuring that your wishes are honored after you pass. While many people may wonder if estate planning costs can be tax-deductible, the answer isn’t as straightforward as one might hope. Understanding what expenses qualify for deductions and how to navigate the complexities of tax laws can make a significant difference in your overall financial strategy.

It’s essential to familiarize yourself with the various deductible expenses associated with estate planning. Engaging legal fees, trust setup costs, and even certain administrative expenses can often be written off on your taxes. However, there are limitations that could affect these deductions based on factors like income level or specific circumstances surrounding each case.

Maximizing deductions requires diligence. Keeping accurate records of all related expenditures will pave the way for potential savings come tax season. Additionally, seeking professional advice not only clarifies which areas offer potential savings but also provides peace of mind knowing you’re making informed decisions about your estate plan.

Understanding whether estate planning is tax-deductible involves more than just looking at numbers; it encompasses strategic decision-making tailored to individual situations. Consulting with experienced professionals ensures that you’re not missing out on opportunities while navigating this complex field effectively.